If you are an SEO expert and looking for SEO new updates with respect to the Google algorithm, then you can consider these points, may these seo points help you. Based on the search results, here̵...

ATES POST: Photograph design performs a vital position in the modern-day digital global. It is not just about growing visually appealing content but additionally approximately effective verbal exchang...

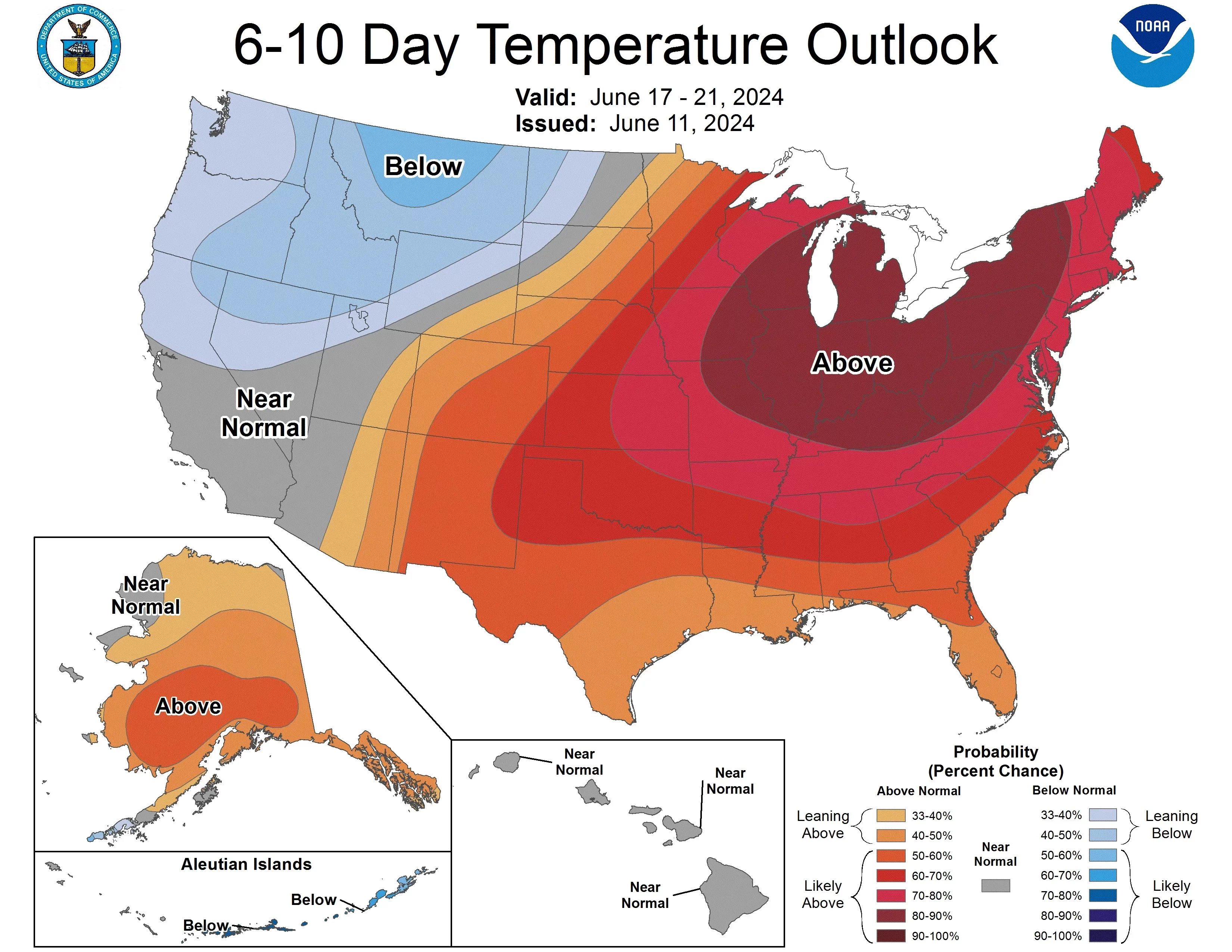

Massive Heat Wave USA Next Week: Friends, the heat wave is increasing day by day. According to a recent report, meteorologists have warned that next week, most parts of central and eastern America wil...

Personalized loans are a valuable tool for anyone looking to achieve their financial objectives in today’s dynamic financial landscape. These loans provide flexibility and convenience for variou...

ATES POST: To deal with the challenges of the 21st century and to promote scientific thinking among all the countrymen, the government has decided to build a science museum all over India. Union Minis...